When you boil it down, furniture removal insurance is a safety net for your belongings during a move. It's a specialised type of cover that protects you against loss or damage from the moment your things are packed up until they're settled in your new place.

The easiest way to think about it? It’s basically travel insurance for your stuff.

Understanding Your Protection During a Move

Moving house is exciting, there's no doubt about it. But let's be honest—it’s also when your most valued possessions are at their most vulnerable. Everything from the big family dining table to your delicate glassware is being handled, loaded, driven across town, and unloaded.

Here’s a common mistake people make: assuming their standard home and contents insurance has them covered. It’s a costly assumption. Most home policies don’t cover goods once they are "in transit." The second your furniture crosses the property line, you could be left completely exposed if an accident happens.

The Role of Specialised Insurance

This is exactly where furniture removal insurance comes in. It’s designed to fill that specific, critical gap. It doesn't matter if you're just moving to a new suburb or heading interstate for a major relocation; this insurance is what gives you genuine peace of mind.

The Australian furniture removals industry is massive, valued at around AUD 1.8 billion in 2023. A huge chunk of that involves long-haul moves between states, which naturally carries more risk. Digging into the Australian removalist market trends makes it clear why having dedicated transit protection isn't just a good idea—it's essential.

Key Takeaway: Furniture removal insurance isn't just some optional add-on. It's a specific policy built for the unique risks of moving. It's there to protect the financial value of your belongings against things you can't control, like accidental damage, truck accidents, fire, or theft during the journey.

For a quick overview, this table breaks down the essentials.

Furniture Removal Insurance at a Glance

| Key Aspect | Simple Explanation |

|---|---|

| What It Is | A specialised insurance policy for your goods while they are being moved. |

| Why It's Needed | Standard home insurance usually doesn't cover items "in transit." |

| When It Applies | From the moment movers start packing until your items are delivered. |

| Core Purpose | To cover the cost of repairing or replacing items lost or damaged during the move. |

Think of it as the barrier standing between a minor hiccup and a major financial headache.

What Does It Actually Cover?

At its heart, removal insurance is all about protecting the value of your possessions. It’s set up to cover the cost to either repair or replace items that get damaged or go missing while in the hands of your removalist.

So, what kind of real-world mishaps are we talking about?

- Accidental breakage when a box of fragile heirlooms is dropped.

- Ugly scratches or dents appearing on your favourite timber sideboard.

- Damage caused by a road accident involving the moving truck.

- The loss of entire boxes due to theft while the truck is parked overnight.

Essentially, it turns what could be a financial disaster into a manageable inconvenience. By having the right policy in place, you’re ensuring that even if the worst happens, you won't be the one footing the bill to replace your cherished belongings. This is the first step to making your move secure and a whole lot less stressful.

How to Actually Read Your Insurance Policy

Opening an insurance policy can feel like trying to decipher an ancient text. The pages are dense with jargon, fine print, and clauses that seem designed to confuse rather than clarify. But here’s the secret: understanding your furniture removal insurance isn’t about becoming a lawyer overnight. It's about knowing where to look for the handful of details that truly matter.

Think of your policy as a user manual for your move's financial safety net. You don't need to memorise the entire thing, just the important bits. Let's focus on finding those sections so you can have genuine peace of mind.

Your Key Documents Explained

When you get a quote for furniture removal insurance, you'll be handed a few key documents. Thankfully, the Australian industry has made big strides in transparency, with regulations requiring authorised removalists to provide clear information. You can learn more about the legal requirements for removal insurance and the consumer protections now in place.

These are the documents you'll want to get familiar with:

- Product Disclosure Statement (PDS): This is your go-to guide. It’s a legally required summary of the policy's main features, benefits, risks, and costs, all laid out in a standardised format. Start here.

- Financial Services Guide (FSG): This document answers the question, "Who am I dealing with?" It explains who is providing the insurance and outlines how they and the removalist get paid. It's all about financial transparency.

- Policy Wording: This is the full-blown contract. While the PDS gives you the highlights, the policy wording contains every specific term, condition, and—most importantly—every exclusion.

Getting a handle on these documents is your first real step toward making sure your belongings are properly protected on moving day.

What to Look For: A Checklist for Clarity

Don't make the mistake of reading your policy from start to finish like a novel. You’ll just get bogged down in legal speak. A much better approach is to go on a scavenger hunt for the specific information that impacts you.

1. The Scope of Cover

Scan for headings like "What We Cover" or "Insured Events." This is where the policy spells out exactly what it protects you against. Is it just for major catastrophes like fire and flood (Restricted Cover)? Or does it also include accidental drops and breakages during handling (Full Accidental Damage Cover)? This is the single most important distinction.

2. The Exclusions List

Just as critical is the section titled "What We Don't Cover" or "Exclusions." This is the fine print where nasty surprises often hide. Common exclusions you’ll want to look for include:

- Damage from mould, mildew, or rust that develops over time.

- Internal mechanical failure of appliances (e.g., your fridge stops working, but there’s no physical damage).

- Damage to items inside boxes you packed yourself (Packed By Owner or PBO).

A word of warning on PBO: Pay very close attention to this clause. If you pack your own glassware and it breaks inside the box during transit, many policies will not cover it. This is a common and costly shock for DIY packers.

3. The Claims Process

Find the section on "How to Make a Claim." This is your emergency action plan. It will tell you exactly who to contact, the deadline for reporting damage (it’s often just a few days after delivery), and what proof you’ll need, such as photos and a copy of your inventory list.

The type of insurance you choose is deeply connected to your overall moving budget. To see how these costs fit together, our guide on the Perth removalists hourly rate can help you build a clearer picture of your total expenses.

By zeroing in on these three areas—what’s covered, what isn’t, and how to claim—you can slice through the complexity and get a real handle on your furniture removal insurance. A few minutes of focused reading now can save you from any unwelcome financial surprises at your new home.

Choosing the Right Level of Insurance Cover

When you look into furniture removal insurance, it can feel a bit like you’re staring at a menu with two options: a basic meal or the full three-course feast. Picking the right one is incredibly important, as it determines how protected you are financially if something goes wrong. The trick is to really understand what each level of cover offers and line it up with the value and type of stuff you’re moving.

One of the biggest mix-ups people have is between the removalist’s business insurance and the insurance that actually covers your goods. It’s a crucial difference. Your mover will definitely have Public Liability Insurance, but that’s there to cover damage they cause to other people’s property, like scraping a wall in your apartment building's hallway. It does nothing for your own furniture.

What you really need for your belongings is a specific policy called Transit Insurance. This is the genuine furniture removal insurance that creates a safety net for your possessions while they're being moved. Let's break down the main types you'll come across.

Restricted Cover for Major Disasters

Think of Restricted Cover as your basic "just in case" plan. It's sometimes called "Listed Perils" or "Total Loss" cover because it’s designed to protect you from major, catastrophic events that are completely out of anyone's control. A policy like this will typically only pay out if your entire load of belongings is lost or destroyed because of a few specific events.

So, what does that usually cover?

- Fire: If the moving truck catches on fire.

- Flood: In the unlikely event your items are damaged by rising waters during the move.

- Collision: Covering your loss if there's a serious road accident involving the removalist's truck.

- Overturning: If the truck rolls over, causing major damage to everything inside.

Restricted Cover is the cheapest option for a reason—its scope is very narrow. It gives you a baseline of protection but leaves a pretty big gap: it does not cover accidental damage from simple handling mistakes.

Full Accidental Damage Cover

This is the all-in option, giving you the highest level of protection you can get for your move. Often called "All Risks" or "Comprehensive Cover," this policy includes everything from a restricted plan plus protection against accidental damage that happens during packing, loading, unloading, and transit.

Let’s paint a picture. A mover is carefully maneuvering your antique oak dresser through a doorway, misjudges the angle, and puts a deep gouge right down the side.

- With Restricted Cover, that's not covered. The repair bill is on you.

- With Full Accidental Damage Cover, you can file a claim to have it repaired.

This level of cover is really about peace of mind. It accepts that even with the best professionals, human error can happen. It protects your things from the drops, dents, scratches, and breaks that can occur during the hustle and bustle of a move.

Matching Your Cover to Your Needs

So, how do you pick? It really boils down to your personal comfort level with risk and, of course, the value of your possessions. Take a moment to think about the replacement cost of your furniture, electronics, and personal belongings.

Here’s a simple way to approach it:

- High-Value Items: If you’re moving expensive electronics, treasured antiques, or designer furniture, Full Accidental Damage Cover is a no-brainer. The extra premium is a small price to pay to safeguard a significant investment.

- Lower-Value Items: If your items are older, not worth a huge amount, or could be replaced without too much financial pain, you might feel fine with Restricted Cover. You're basically accepting the risk of minor accidental damage in exchange for a lower insurance cost.

Your goal is to find that sweet spot. A good furniture removal insurance policy should match the real-world value of what you're moving, making sure you’re not left footing a massive bill if the unexpected happens.

Finding a Reputable and Insured Removalist

Choosing the right furniture removal insurance is a huge step, but it’s only one part of the equation. The other, equally critical part, is picking the right removalist. Let's be honest, even the best insurance policy in the world can't undo the stress of dealing with a careless mover. The real aim is to hire a team so professional that you'll likely never need to use the insurance in the first place.

Think of it like this: your insurance is the safety net, but a top-notch removalist is the skilled trapeze artist who rarely, if ever, makes a mistake. Your goal is to find that pro, making the safety net a reassuring backup rather than a necessity. The very first clue you're dealing with a professional is their commitment to proper insurance and industry standards.

The AFRA Advantage

Here in Australia, one of the biggest green flags you can look for is membership with the Australian Furniture Removers Association (AFRA). This isn't just some fancy logo they can stick on their truck; it’s a genuine mark of quality and accountability. AFRA is the industry's governing body, and they set a high bar for everything from staff training and equipment to, you guessed it, insurance.

For you, the customer, choosing an AFRA member comes with some serious perks built right in.

- Mandatory Insurance: Every single AFRA member is required to hold both Public Liability Insurance and Transit Insurance. This gives you a fundamental layer of financial protection from the get-go.

- Strict Audits: These companies aren’t just checked once. They undergo regular, rigorous audits to make sure they're consistently meeting AFRA's high standards for safety and professionalism.

- Dispute Resolution: If something does go wrong and you can't sort it out directly with the removalist, AFRA has a tribunal to step in and help mediate the dispute.

With around 350 member companies across the country, the association represents a network of thoroughly vetted professionals. You can think of AFRA accreditation as a powerful shortcut to finding a trustworthy mover.

Choosing an AFRA member offers a clear advantage over going with a non-accredited company, especially when it comes to protection.

AFRA Member vs Non-Member Removalist

| Feature | AFRA Member | Non-Member |

|---|---|---|

| Guaranteed Insurance | Yes, Transit & Public Liability are mandatory. | Uncertain, depends entirely on the company. |

| Standards & Training | Must meet strict AFRA standards for staff and equipment. | No required standards; quality can vary wildly. |

| Dispute Resolution | Access to an independent tribunal for unresolved issues. | You're on your own; may require legal action. |

| Accountability | Accountable to a governing body. | Accountable only to themselves and consumer law. |

Ultimately, choosing an AFRA-accredited removalist provides an established framework of trust and protection that you simply don't get with a non-member.

Questions to Ask Before You Hire

Before you sign on the dotted line with any removalist, it's time to put on your investigator hat. A few direct questions can tell you everything you need to know about their professionalism and whether they’re the right team for your job. Don't be timid—a good company will welcome your questions and have clear, confident answers ready.

Here are the non-negotiables to ask:

- "Are you an AFRA member?" It's the perfect opening question to gauge their commitment to industry best practices.

- "Can you provide a copy of your insurance Certificate of Currency?" This is the proof. It shows their policies are active and up-to-date.

- "What type of Transit Insurance do you offer?" You need to know if it's a basic 'restricted' policy or comprehensive 'accidental damage' cover, and how you go about purchasing it.

- "What is your process for handling and reporting damage?" A professional outfit will have a clear, documented procedure. No "ums" or "ahs."

Red Flag Warning: Be very cautious of any company that gets cagey about their insurance details, tries to push you into a cash-only deal, or can’t produce any official paperwork. These are classic signs of a dodgy operator, and it could leave you completely exposed if things go sideways.

Of course, finding the right movers involves more than just checking their insurance. For a complete guide on what to look for, from quotes to customer reviews, check out our expert tips to select furniture removalists in Perth.

At the end of the day, you're not just hiring a service; you're looking for a partner in your move. A company that’s transparent about its furniture removal insurance, proud of its accreditations, and happy to answer all your questions is a company you can trust. Taking the time to be selective is your best defence against a stressful move, ensuring that from the first box packed to the last armchair set down, your belongings are in safe, professional hands.

A Step-By-Step Guide to Making a Claim

Even with the most professional removalists on the job, accidents can happen. It’s a gut-wrenching moment when you discover a treasured piece of furniture is damaged or something has gone missing entirely. But if you've got the right furniture removal insurance, this is just a temporary setback, not a permanent loss.

Knowing exactly what to do when you spot a problem is what separates a smooth claims process from a nightmare. The first few steps you take are the most important. Staying calm and following a clear procedure is the best way to protect your rights and get a straightforward resolution from your insurer.

Your Immediate Action Plan

Time is of the essence here. Most insurance policies have a strict window for reporting damage or loss, sometimes just a few days after your delivery. Acting quickly and methodically is your best defence.

The moment you notice something’s wrong, this is what you need to do:

- Stop Unpacking: If you see damage, stop what you're doing. Leave the item and its packaging exactly where it is. This preserves crucial evidence.

- Document Everything: Get your phone out and take clear, well-lit photos of the damage from every possible angle. Get wide shots to show where the item is, and then get close-ups to detail the specific damage. If a box looks crushed, snap a picture of it before you even open it.

- Find Your Paperwork: You'll need the inventory list (or condition report) that was filled out before the move started. This is your proof of the item's original state. Grab your moving contract and insurance policy details, too.

- Notify the Removalist Immediately: Contact the moving company in writing. An email is perfect because it creates a paper trail. Briefly explain what happened, identify the damaged item, and state that you will be starting an insurance claim.

Taking these initial steps lays a solid foundation for your claim. It gives both the removalist and the insurer the clear evidence they’ll need to see.

Gathering Your Evidence and Filing the Claim

Once you've given the mover a heads-up, it’s time to formally prepare and submit your claim. This is where being organised really pays off. You’ll need to create a file with all the documents required to back up your case.

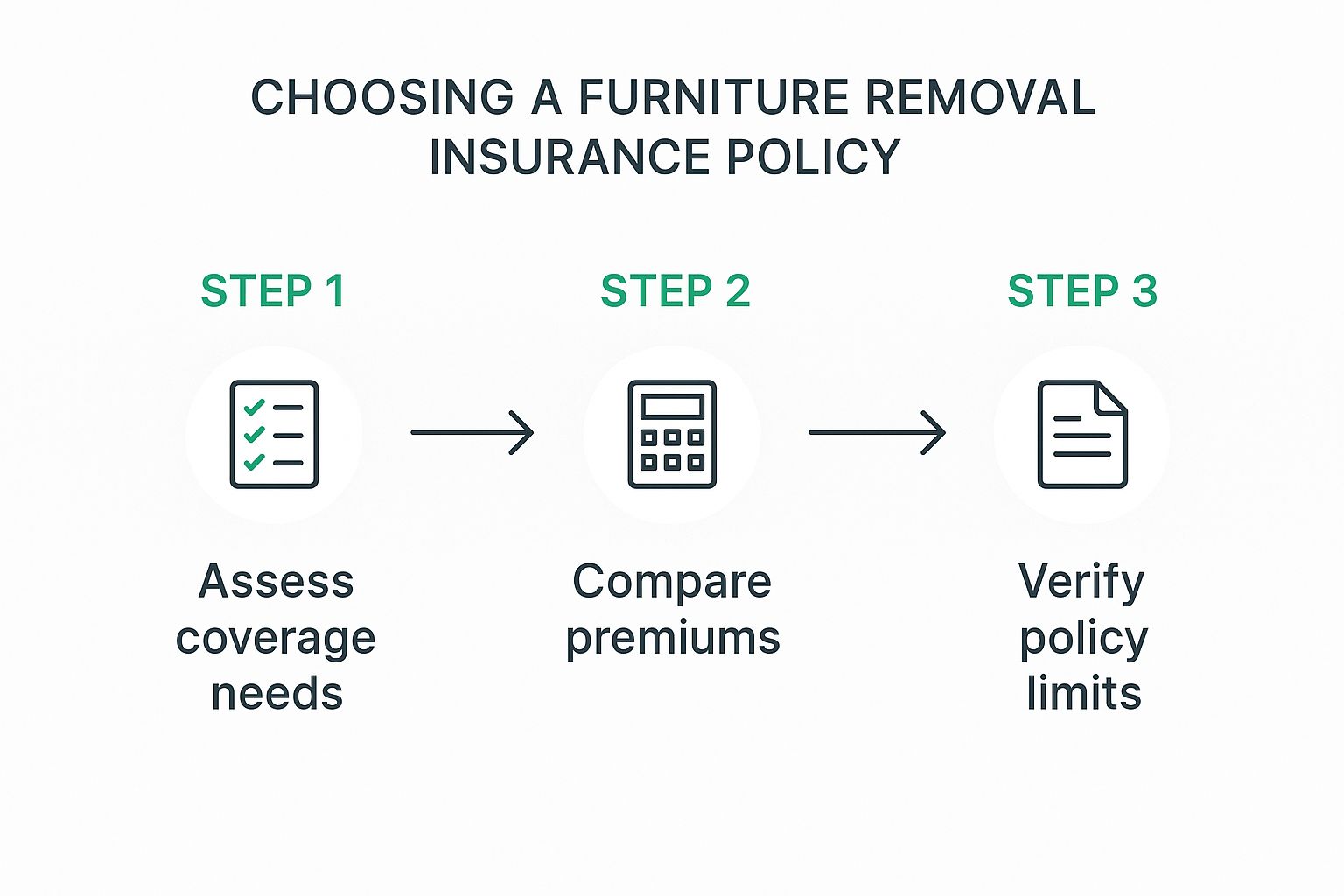

This following infographic outlines the key steps to follow when choosing your insurance, a process that becomes vital when it's time to make a claim.

As the infographic shows, thinking ahead by assessing your needs, comparing costs, and checking policy limits makes the claims process far more predictable when you actually need it.

Your insurer will likely ask for the following:

- A Completed Claim Form: They will provide you with a specific form to fill out. Be as detailed and accurate as you possibly can.

- Proof of Ownership and Value: This could be original receipts, credit card statements, or for valuable items like antiques or art, a professional valuation.

- Your Photographic Evidence: Send them all the clear photos you took of the damage.

- A Copy of Your Moving Contract: This proves your agreement with the removalist company.

- Your Inventory List: This document, signed before the move, is your primary evidence of the item’s existence and its condition before it was loaded onto the truck.

Key Insight: Whatever you do, don't throw away a damaged item until your claim is fully processed and settled. The insurer has every right to inspect the item themselves or send an assessor to look at it.

Communication and Follow-Up

After you've submitted your claim, it’s important to maintain clear and professional communication with both the removal company and the insurer. Keep a log of every conversation—note down dates, times, and the names of the people you speak with. For a closer look at best practices, you can review these essential insurance tips for a stress-free move to make sure you’ve covered all your bases.

If you don't hear back within the timeframe they gave you, follow up politely. By being prepared, organised, and proactive, you can navigate the claims process with confidence. It turns a really stressful situation into a manageable task and helps you get the resolution you deserve.

Common Myths About Moving Insurance Debunked

Navigating the world of furniture removal insurance can be a bit confusing, and a few common misunderstandings can end up costing you dearly. A lot of people make assumptions about what’s covered during a move, leaving themselves financially vulnerable right when they can least afford it. Let's clear the air and tackle these myths head-on.

Relying on these falsehoods is a bit like driving without a seatbelt. You might be fine, but if something goes wrong, the fallout can be serious. Once you know the facts, you can make a smart decision that genuinely protects your possessions.

Myth 1: My Removalist Is Automatically Responsible

This is probably the most common—and most expensive—misconception out there. People often think that if a mover drops a box or dings their dining table, the company is automatically on the hook for the full replacement cost. Under Australian law, this simply isn't the case.

While removalists are required to take due care, their legal liability is often capped. Without a proper transit insurance policy in your name, you might only get back a tiny fraction of an item's value, as dictated by their standard terms and conditions. The removal company's own insurance is there to protect their business, not your things.

The Reality: A removalist’s liability is strictly limited by their terms of service. Only a dedicated furniture removal insurance policy, taken out by you, ensures your belongings are covered for their full, declared value against accidental damage.

Myth 2: My Home and Contents Insurance Will Cover Me

Here's another classic mistake: assuming your existing home and contents policy has your back during a move. While that policy is fantastic for protecting things inside your home, most have a critical blind spot: they don't cover your goods once they're "in transit."

Think of your property line as an invisible fence. The moment your sofa crosses it and gets loaded onto the truck, it often steps outside the protection of your home insurance. Sure, there might be some rare exceptions, but they usually offer very limited cover. It's crucial not to assume—you need to dig into the fine print of your Product Disclosure Statement (PDS) and look for a specific clause about "goods in transit."

Myth 3: Cheaper Insurance Is Just as Good

It’s always tempting to go for the cheapest insurance premium you can find, but this is often a perfect example of "you get what you pay for." A rock-bottom price usually points to a "Restricted Cover" policy, which only protects against major disasters like a fire, flood, or the truck overturning.

What it almost certainly won't cover are the far more common moving day mishaps, such as:

- Accidental drops while loading or unloading.

- Scratches, scuffs, and dents that happen during handling.

- Breakage of fragile items packed inside a box.

Real peace of mind typically comes from a "Full Accidental Damage" policy. It costs a bit more, yes, but it’s designed to cover the very human errors that are much more likely to happen during a move. Always compare what's actually covered, not just the price tag.

Frequently Asked Questions

Even after walking through the main points of furniture removal insurance, there are always a few extra questions that come up. Getting straight answers to these common queries is the final step in feeling confident and truly ready for your move.

Think of this as the fine print, made simple. Let’s tackle those lingering questions so you know exactly where you stand.

How Is the Cost of Furniture Removal Insurance Calculated?

So, how do insurers land on a final price? The cost you pay, your premium, is almost always tied directly to the total value of the items you're moving. You'll need to create a list of your belongings and declare what it would cost to replace them today.

Your premium is then calculated as a percentage of that total value, typically landing somewhere between 1% and 4%.

But other things can nudge that price up or down. Key factors include:

- The distance of your move: A local job will cost less to insure than a cross-country haul.

- The level of cover you select: Basic restricted cover is cheaper than comprehensive accidental damage insurance.

- The excess you choose: Agreeing to a higher excess can sometimes lower your premium.

Before you sign anything, make sure you get a detailed quote that clearly breaks down how they arrived at the final figure.

Do I Need Insurance if I Pack My Own Boxes?

Yes, absolutely—but you need to be very careful here. Most policies have a specific clause for items "Packed By Owner," often abbreviated as PBO. If something you packed yourself gets damaged, the insurer might refuse to pay out because they can't vouch for how well it was packed.

For example, if a box you packed gets dropped and your plates smash, the damage probably won't be covered. But if that same box is destroyed in a major incident like a truck fire, your transit insurance should still cover the total loss. It's crucial to read the PBO section of your policy to understand these distinctions.

What Is an Insurance Excess and How Does It Work?

The excess is simply the amount you agree to pay out of your own pocket before the insurance company steps in. It's your contribution towards the claim.

Let's say your policy has a $250 excess. If you make a successful claim for $1,000 to repair a damaged coffee table, you would pay the first $250. Your insurer then covers the remaining $750. Some companies will offer you a lower premium if you're willing to take on a higher excess, so always check this figure when you're comparing quotes.

When you're ready for a smooth and secure move in Perth, trust the team that treats your belongings like their own. For a transparent quote and professional service, get in touch with Emmanuel Transport. Learn more and book your move at https://emmanueltransport.net.au.